United Way Tax Preparation Service

Posted by Greg Starup

on Oct 20, 2012

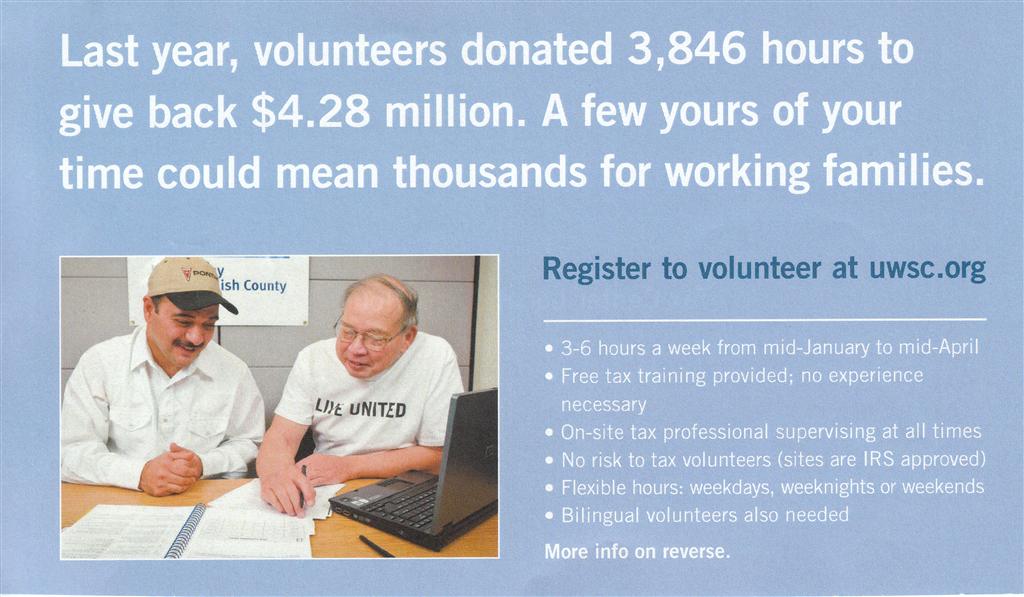

United Way provides tax preparation services worth $2.8 million annually, to individuals who otherwise would could not afford professional services. The service results in tax refunds and Earned Income Credits to people in need who would otherwise forfeit these funds. Volunteers are needed to perform these services. They are trained and certified by the IRS. The tax season runs from January 22nd through April 15th, and volunteers are asked to commit to 3-4 hours per shift, once a week for 12 weeks.

Ian Nelson of the United Way presented at our meeting of October 10th. Contact him at United Way for more information.